Materials Supply Chain

July 14, 2014

As an accident of

natural selection,

humans have ten

fingers. This ten digit body plan is actually pervasive among

species, so the apparently

random choice of ten, and not eight or twelve, happened early in

evolution. Such similarities among species are called

homologies, and

Darwin cited these as evidence for a

common ancestor. It was easier for

nature to use the same simple structures, so these persisted with just small variation.

We have ten fingers, so our

arithmetic is

decimal. We tend to use whatever nature has given us. Our

civilization is likewise built from the

materials at hand. We use a lot of

wood, and we found many

millennia ago that scratching into

Earth's crust a little can give you

precious stones, and such useful

metals as

copper,

silver, and

gold. Later, we learned to extract

iron from

mined ores; and, much later, we learned how to make

synthetic diamonds.

Fortunately, the

Earth didn't

solidify into a

homogeneous mass. Because of

thermochemical forces, some

elements were concentrated into ores, and some

geographical regions have more of one kind of ore than another.

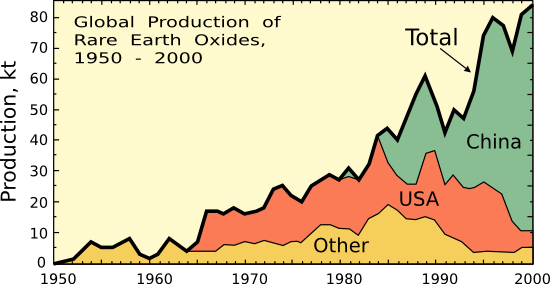

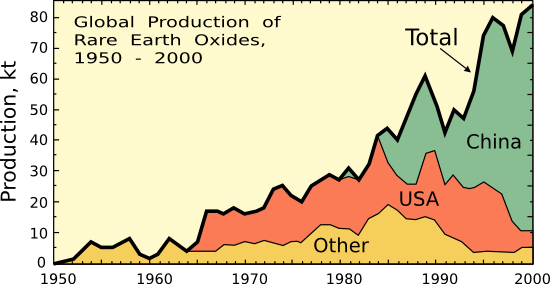

Rare earth elements, which are useful for making

catalysts, photovoltaics and permanent magnets, have been mined in the United States,

India,

Brazil, and

South Africa, but

China is now the leading producer.

In a

previous article (Rare Earth Shortage, June 21, 2010), I described how China had started to limit exports of these elements, and this policy has continued. China's limiting of rare earth

exports has encouraged the reopening of mining operations elsewhere, but there's still the problem of extraction. As are many other

chemical processes, extraction of rare earths from ore and their

purification are not that

environmentally friendly; but, how else can we get our

motorized automobile windows?

|

| This graph illustrates how the US ceded its dominance in rare earth production to China in the mid-1980s. (Via Wikimedia Commons.) |

The rare earth elements are not the only chemical elements that are part of the

high technology products we wouldn't want to live without. In a

previous article (Energy Elements, May 11, 2011), I wrote about a joint report of the The

American Physical Society (APS) and the Materials Research Society (MRS), "Energy Critical Elements: Securing Materials For Emerging Technologies." [1-2] This report highlights the importance of many of the rare earth elements and other elements important to energy technologies; viz.,

This report recommends product design for

recycling and research and development on substitute materials. One mitigation technique cited in the report, but not likely to be popular, is lifestyle adaptation. No automatic automobile windows for you!

The US Department of Energy released a December, 2010, report on Critical Minerals Strategy.[3] This report highlights as "most critical" the rare earth elements, dysprosium, neodymium, terbium, europium and yttrium. Indium is also named as a most critical material. One interesting fact about indium, and a good reason for research on substitute materials, is that indium is a byproduct of

zinc production. It's not likely that you would mine more zinc just to get more indium.

As if mineral scarcity wasn't enough, we now need to worry that our technology contains extracts from

conflict minerals. These minerals are the technology equivalents of

blood diamonds that are used to fund

armed conflicts in

Africa.

Although "3TG" might sound like a new

cellphone service, this shorthand actually represents the four principal conflict minerals; namely, tantalum, tin, tungsten and gold. In the US, a

miscellaneous provision of the

Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010 required

companies to disclose the sources of these materials in their products.

Rulemaking by the

US Securities and Exchange Commission, which was charged with the oversight for this law, wasn't completed until 2012. Since that time, US companies have attempted to track the mineral sources of their products. The first reports were due on May 31, 2014.

As can be imagined, this is a difficult task for many companies, since it applies not only to products that they make, but also to products that they have made for them by

contractors. In a May 29, 2014, filing,

Apple, Inc. reported that "...all tantalum

smelters in its supply chain had been designated 'conflict free'..."[4] As for the other metals, a majority were either certified as conflict free, or have been found to be so by an independent

auditors. Says Apple,

"Apple will keep up the pressure until all unaudited smelters and refiners are either certified or removed from Apple's supply chain."[4]

Intel announced early this year that all its

microprocessors would be free of conflict minerals.

In its own report,

Honeywell, Inc., a large

diversified manufacturer of such things as

jet engines and building

thermostats, wrote that it sells 915,000 products using materials from 24,000 direct material suppliers.[5] Honeywell does not deal with conflict mineral suppliers, directly, so it relies on reporting from its own suppliers. It has begun to require conflict mineral compliance into its new

purchase agreements.[5]

References:

- Robert Jaffe, Jonathan Price, Murray Hitzman and Francis Slakey, "The Back Page - Energy Critical Elements," APS News, vol. 20, no. 4, March, 2010.

- Energy Critical Elements: Securing Materials for Emerging Technologies, A Report from the APS Panel on Public Affairs Committee and the Materials Research Society (MRS), February 2011.

- Critical Minerals Strategy (US Department of Energy, December, 2010).

- Conflict Minerals Disclosure for January 1 to December 31, 2013, Apple Inc., May 29, 2014.

- Conflict Minerals Report for the Year Ended December, 2013, Honeywell, Inc.